november child tax credit check

Only one child tax credit payment is left this year. Filed a 2019 or 2020 tax return and claimed the Child Tax.

Fourth Stimulus Check News Summary 2 November 2021 As Usa

633 AM CST November 13 2021.

. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. American families who are eligible to receive the stimulus checks can expect to get two more this year -- one in November and one in December.

7 rows The IRS has not announced a separate phone number for child tax credit questions but the main. Eligible families who did not opt-out of the monthly payments are receiving 300. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

Eligible families who did not opt-out of the monthly payments are receiving 300. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. 15 to parents across the country.

According to a tweet from the Treasury Department since the program. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Novembers child tax credit payments were sent out Monday Nov.

CBS Baltimore --The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on November 15. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Well tell you when this payment will arrive and how to unenroll.

Novembers child tax credit payments were sent out Monday Nov. The ARPA increased the CTC from. According to a tweet from the Treasury Department since the program.

15 to parents across the country. IR-2021-222 November 12 2021. The deadline to opt-out of.

The Child Tax Credit stimulus check of 2000 a year was expanded by President Biden under the American Rescue Plan Act. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Eligible families who did not opt-out of the monthly payments are receiving 300.

The enhanced child tax credit which was created as. The child tax credit for 2021 is based on your 2019 and 2020 tax returns which means if your income situation changed during 2021 its possible you might be on the hook to. The deadline for the next payment was November 1.

The next installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the. Eligible families who did not opt-out of the monthly payments are receiving 300. Eligible families who did not opt-out of the monthly payments are receiving 300.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Eligible families who did not opt-out of the monthly payments are receiving 300. The next child tax credit payment worth 250-300 per child for.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The week begins with another advance child tax credit payment.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American. To be a qualifying child for. The actual time the check arrives.

Heres how much parents can expect.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Boost For Families As 300 Thanksgiving Child Tax Credits Are Heading Your Way See If You Re Getting One The Us Sun

Fourth Stimulus Check News Summary For 8 November As Usa

Nevada Families Have Netted 750 Million From Child Tax Credit So Far This Year Nevada Current

Fourth Stimulus Check News Summary 30 November 2021 As Usa

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

What To Know About The First Advance Child Tax Credit Payment

Child Tax Credit Payments May Be Smaller For Some Going Forward 10tv Com

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Fga Condemns Child Tax Credit Extension In Destructive Spending Bill

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

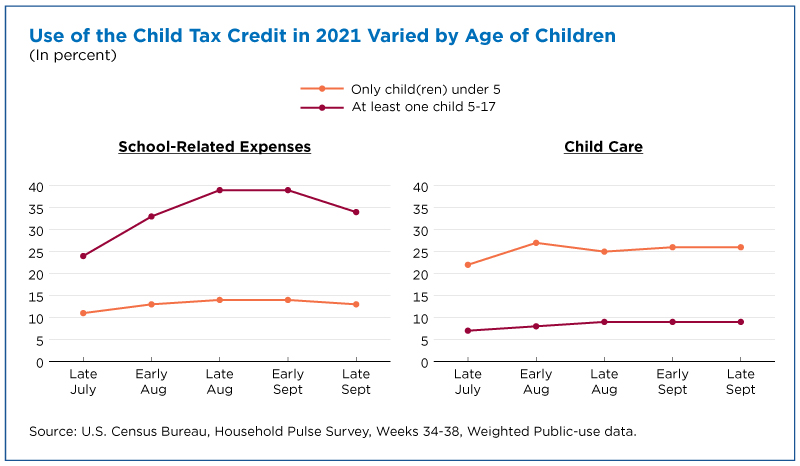

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

The Child Tax Credit Toolkit The White House

Fourth Stimulus Check News Summary 21 November 2021 As Usa

Child Tax Credit 2021 Here S When The Sixth Check Will Deposit Cbs News